Form 199 Instructions⁚ A Comprehensive Guide

This guide provides comprehensive instructions for completing California’s Form 199, the Exempt Organization Annual Information Return. It covers filing requirements, due dates, and a step-by-step completion process. We also clarify Form 199’s differences from FTB 199N and explain e-filing options. Consult the FTB website for updated information.

Who Must File Form 199?

California Form 199, the Exempt Organization Annual Information Return, mandates filing by specific nonprofit organizations operating within the state. This includes organizations granted tax-exempt status by the Franchise Tax Board (FTB), operating under California Revenue and Taxation Code (R&TC) Section 23701. Crucially, nonexempt charitable trusts, as defined under Internal Revenue Code (IRC) Section 4947(a)(1), are also obligated to file. The requirement stems from the need to report financial information relevant to maintaining their tax-exempt status. Note that certain organizations may be exempt from filing; refer to the complete instructions for details on exceptions and specific criteria. Failure to file when required can lead to penalties and potential revocation of tax-exempt status. Always consult the most recent FTB guidelines and publications for the most up-to-date information on filing requirements.

When is Form 199 Due?

The due date for filing California Form 199, the Exempt Organization Annual Information Return, is crucial for maintaining compliance and avoiding penalties. While the provided text doesn’t explicitly state a single due date, it strongly implies that the deadline aligns with the general timeframe for other similar tax filings. This suggests a deadline typically falling on or before the 15th day of the fifth month following the close of the organization’s tax year. For example, if your organization’s tax year ends on December 31st, the Form 199 would likely be due on May 15th of the following year. However, it’s imperative to verify this deadline on the official California Franchise Tax Board (FTB) website. The FTB website provides the most current and accurate filing deadlines, and it’s essential to consult their resources to confirm the precise due date to ensure timely submission and prevent potential penalties for late filing. Remember that extensions may be available under specific circumstances, but these must be applied for in advance.

Form 199⁚ Understanding the Filing Requirements

California Form 199, the Exempt Organization Annual Information Return, mandates reporting by various non-profit entities. Organizations granted tax-exempt status by the Franchise Tax Board (FTB) are generally required to file. This includes those operating under Revenue and Taxation Code (R&TC) Section 23701. Furthermore, non-exempt charitable trusts, as defined under Internal Revenue Code (IRC) Section 4947(a)(1), also fall under this requirement. The filing obligation hinges on maintaining tax-exempt status within the state of California. Failure to file can lead to the revocation of this status and potential penalties. The specific requirements, including detailed financial reporting and information disclosure, are outlined in the official Form 199 instructions available on the FTB website. It’s crucial to thoroughly review these instructions to ensure complete and accurate compliance. Note that there are exceptions; some organizations may be exempt from filing, as indicated in the instructions themselves. Always refer to the latest official FTB guidelines for the most up-to-date information.

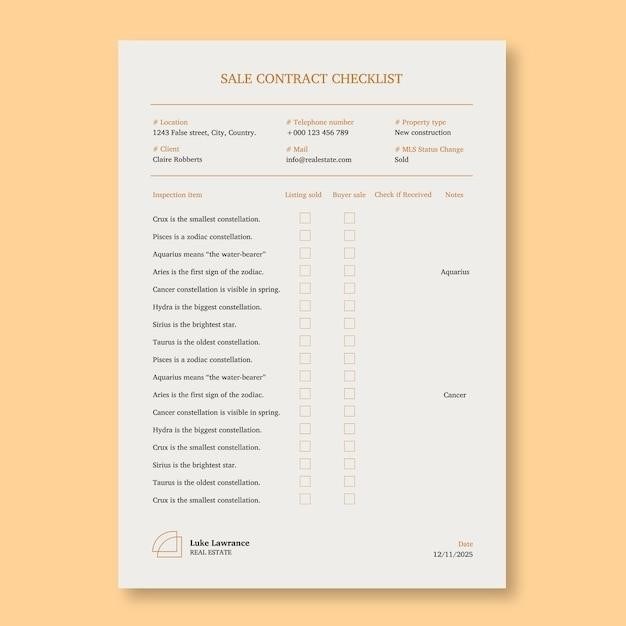

Completing Form 199⁚ A Step-by-Step Guide

Accurately completing Form 199 requires a methodical approach. Begin by gathering all necessary financial records, including detailed income statements, expense reports, and balance sheets. Carefully review the instructions for each section of the form, ensuring a clear understanding of the required information and its presentation format. Part I requires general organizational details and key financial data such as gross receipts. Part II delves into more detailed financial reporting, often requiring specific line-item entries for various revenue and expense categories. Double-check all figures for accuracy, ensuring consistency between different sections of the form. If unsure about a specific entry or requirement, consult the provided instructions or contact the FTB directly for clarification. Remember to maintain organized records of all supporting documentation, in case of future audits or inquiries. While electronic filing is often encouraged for efficiency and accuracy, ensure your chosen method aligns with FTB guidelines. Thorough preparation and attention to detail are crucial for a successful and compliant Form 199 filing.

Part I of Form 199⁚ Key Information and Reporting

Part I of Form 199 demands meticulous attention to detail, serving as the foundational section for your organization’s annual return. Begin by accurately identifying your organization’s name, Employer Identification Number (EIN), and the tax year covered by the return. Provide precise details about your organization’s principal business activity and its location. The reporting of gross receipts requires careful calculation, ensuring that all sources of revenue are accurately accounted for. Similarly, reporting total assets necessitates a thorough review of your organization’s financial records. Accurate completion of this section is paramount, directly impacting the overall validity and acceptance of your entire Form 199 filing. Double-check all entries for accuracy, ensuring consistency with your supporting documentation. Pay close attention to any specific instructions provided within Part I to avoid common errors. Remember, the information provided in Part I lays the groundwork for the more detailed financial reporting in subsequent sections.

Part II of Form 199⁚ Detailed Financial Reporting

Part II delves into the specifics of your organization’s financial performance during the tax year. This section requires a comprehensive understanding of your organization’s accounting practices and a thorough review of your financial records. Accurate reporting of revenues, expenses, and disbursements is critical. Ensure that all income sources are correctly categorized and that expenses are properly documented. Pay particular attention to the instructions for each line item, ensuring that your entries align with the definitions provided. The detailed breakdown of expenses should reflect the true nature of your organization’s expenditures. If you utilize specialized accounting software or engage the services of a professional accountant, ensure that the data transferred to Form 199 is accurate and complete. Any discrepancies or omissions could lead to delays in processing or requests for further clarification from the FTB. Maintain supporting documentation for all entries to facilitate any potential audits or inquiries. Thoroughness and accuracy in completing Part II are vital for a successful Form 199 filing.

Form 199 and the IRS⁚ Key Considerations

While Form 199 is a California state filing, it has significant interplay with your federal tax obligations. Your federal tax-exempt status with the IRS (if applicable) directly impacts your eligibility to file Form 199 and the information you report. Maintaining consistent reporting between your IRS filings (such as Form 990 or 990-EZ) and Form 199 is crucial; Discrepancies between these filings can trigger scrutiny from both the IRS and the FTB. Ensure that your organization’s financial records are meticulously maintained to support the information reported on both federal and state forms. If your IRS status changes, promptly notify the FTB to avoid potential penalties or complications. Understanding both the federal and state tax regulations governing your organization is essential. Consult with a tax professional if you have questions about the interaction between your federal and state tax filings to ensure compliance with all regulations.

Form 199 vs. FTB 199N⁚ Understanding the Differences

California offers two primary annual information return forms for tax-exempt organizations⁚ Form 199 and FTB 199N. The key differentiator lies in the organization’s gross receipts. FTB 199N is designed for smaller organizations with gross receipts generally equal to or less than $50,000. This simplified form streamlines the reporting process for these entities. Conversely, Form 199 is utilized by organizations with gross receipts exceeding $50,000. It requires more detailed financial reporting, encompassing a broader range of income and expense categories. Choosing the correct form is critical; filing the incorrect one can lead to delays, penalties, or requests for amended returns; Carefully review your organization’s financial records to determine your gross receipts for the tax year to ensure accurate form selection. The FTB website provides detailed guidance to help you select the appropriate form based on your organization’s financial activity.

E-Filing Form 199⁚ A Convenient Option

E-filing Form 199 offers a streamlined and efficient alternative to traditional paper filing. This method significantly reduces the administrative burden associated with manual submission, including the time required for printing, mailing, and tracking. Electronic filing ensures prompt delivery to the Franchise Tax Board (FTB), minimizing the risk of processing delays. Many tax preparation software packages offer integrated e-filing capabilities, simplifying the process for users. The FTB’s website provides detailed instructions and resources to guide you through the online submission process. E-filing also enhances security, reducing the chance of lost or misplaced documents. Moreover, it allows for quick confirmation of receipt and facilitates easier communication with the FTB should any questions or clarifications arise. For taxpayers who prefer a digital approach to tax compliance, e-filing Form 199 presents a convenient and efficient solution. Remember to verify the FTB’s recommended e-filing providers before proceeding;

Additional Resources and Contact Information

For further assistance with Form 199, the California Franchise Tax Board (FTB) offers a wealth of online resources. Their website, ftb.ca.gov, provides comprehensive instructions, FAQs, and downloadable forms. You can access publications and guides that address specific aspects of Form 199 completion and filing. The FTB website also features a search function to easily locate relevant information. For those requiring personalized support, the FTB offers various contact options, including a dedicated phone line for inquiries regarding Form 199 and other tax-related matters. Consider consulting with a qualified tax professional if you require assistance in interpreting instructions or navigating complex situations. Many accounting firms specialize in providing guidance on Form 199 compliance for tax-exempt organizations. Remember to always refer to the most up-to-date information available on the official FTB website to ensure compliance with current regulations and deadlines.